The Best Crypto Prop Firm in 2025?

🚀 Why Choose a Crypto Prop Firm?

Crypto proprietary trading firms (“prop firms”) offer traders access to funded accounts after passing evaluation phases—typically a challenge or instant funding. Instead of risking your own capital, you prove your strategy in a simulated or demo environment under the firm’s guidelines. Once successful, you trade with real capital and share the profit. CFT caters to crypto and other markets, offering a low-risk gateway to trading funded capital.

👉 Start trading with Crypto Fund Trader

Introducing Crypto Fund Trader (CFT)

Crypto Fund Trader (CFT), backed by Swiss company Swiss RLcrates AG and centered in Zug, Switzerland, launched in 2024. It lets traders access up to $300,000 via its programs—but what makes it special?

🎯 Multiple Programs for Different Traders

Instant Funding

- Accounts: $2.5K / $5K / $10K, scalable to over $1.2M

- No minimum trading days—start trading and earning immediately

- Risk rules: ≤4% daily drawdown, ≤6% total drawdown; profit target 10% for scale-up

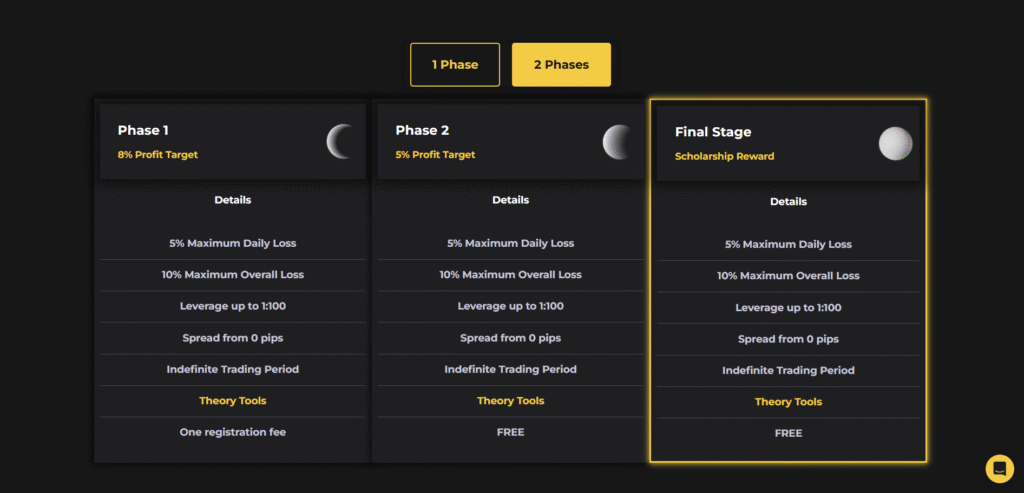

1‑Phase / 2‑Phase Challenges

- Available balances: $5K–$200K

- 1‑Phase: achieve 10% profit, ≤4% daily and ≤6% overall drawdown

- 2‑Phase: typically 8% then 5% profit goals with similar drawdown limits

- Minimum 5 trading days; no time limit to complete the challenge

👉 Explore CFT’s funding options

🛠️ Assets, Leverage & Tech

- Markets available: 125+ crypto pairs, 39 Forex, 15 indices, 10 commodities, 25 stocks

- Leverage:

- Student accounts: Forex 1:30, crypto 1:5

- Advanced/funded accounts: up to 1:100 across all asset types

- Platforms: MT5, proprietary web/desktop/mobile, plus a futures-specific platform

- Algo traders welcome (no high-frequency or arbitrage EAs)

💰 Profit Splits, Fees & Funding

- Profit share: 80% to the trader, 20% to CFT

- Instant Funding: sliding scale from 50% up to 90% as you scale

- Costs: Zero spreads, low commissions

- Payments accepted via crypto or credit card

👉 Join now to keep up to 90% profit

👍 Strengths at a Glance

- Diverse asset access: Crypto, Forex, indices, commodities & stocks

- Competitive leverage & cost structure

- Multiple program types for all trader profiles

- Fast payouts & responsive support (as per many user reviews)

⚠️ Pay Attention: Risks & Red Flags

While CFT has an overall positive reputation, it’s not without criticism:

- Some users report software glitches and platform reliability issues

- Others mention slow support response or hidden rules

- The firm currently has no official regulatory oversight mentioned publicly

- Scamadviser has flagged some transparency concerns

👉 Try CFT with a small account

🧭 Verdict: Is CFT the Best Crypto Prop Firm?

CFT offers a strong value proposition for traders looking to trade funded capital in crypto and other markets. The flexible funding programs, wide asset access, generous profit splits, and fast payouts make it attractive.

However, prospective users should conduct due diligence, test with smaller accounts first, and monitor support/service quality over time.

📝 Tips Before You Commit

- Use the free trial or demo account to evaluate performance

- Start with a low-cost program to understand rules and processes

- Read the terms carefully—especially around drawdowns and profit targets

- Keep records of all communications and trades for reference

🔎 Other Firms Worth Comparing

If you’re shopping around, consider comparing with:

- Topstep – Strong in futures with some crypto

- Cumberland / DRW – Institutional-level firm but not retail focused

Still, if your goal is crypto-centric trading with access to real capital and customizable paths, CFT ranks among the top picks in 2025.

🏁 Final Summary

Crypto Fund Trader stands out with:

- Multiple funding paths

- Rich asset access

- High leverage and fair cost structure

- Proven payouts

But stay smart: use demo mode, review terms, and start small.